-

Hong Kong's wine industry is

supported by a significant pool of experienced

fine wine merchants with good wine knowledge and

international wine trade experience. Besides

wine trading and distribution, wine-related

business includes auction, retailing,

warehousing, catering and transportation.

-

Since the removal of all

duty-related customs and administrative controls

in February 2008, Hong Kong has further

developed into a wine trading and distribution

centre for the region, particularly for the

Chinese mainland.

-

Hong Kong has entered into an

agreement with the mainland Chinese Government,

allowing wine imports to go into China under CEPA and

enhanced customs facilitation measures.

Industry Features

Hong Kong has a significant pool of

experienced fine wine merchants with good wine

knowledge and international wine trade experience.

Amid the growing demand for wine in Asia, the Hong

Kong government removed all duty-related customs and

administrative controls for wine in February 2008 to

facilitate the development of Hong Kong as a wine

trading and distribution centre for the region,

particularly the Chinese mainland. Besides wine

trading and distribution, wine-related business

includes auction, retailing, warehousing, catering

and transportation.

Following the deregulation,

development of the wine industry has accelerated.

Wine imports surged some 80% in the first year.

According to an ad hoc survey carried out by the Commerce

and Economic Development Bureau to evaluate the

economic benefits of wine duty exemption, about 850

new wine-related companies were set up in Hong Kong

in 2008 and 2009, bringing the total to 3,550; the

wine sector as a whole gained HK$5.5 billion worth

of wine-related business receipts in 2009,

representing an increase of over 30% as compared

with 2007; and the number of employees engaged in

wine-related business increased by more than 5,000

as compared with 2007, reaching 40,000 by the end of

2009. This increase in employment was equivalent to

about 1,000 full time jobs, 60% of which were for

front-line staff; and the number of wine-related

manpower and professional courses (including

sommelier training as well as wine

business/management courses) grew from 21 in 2007 to

86 in 2009. The number of participants in these

courses reached over 8,500 in 2009, representing an

increase of more than two times as compared with

about 2,400 participants in 2007.

Hong Kong has entered into an

agreement with the mainland Chinese Government,

allowing wine imports to go into China under CEPA

and enhanced customs facilitation measures. This

makes the city an unrivalled gateway to China,

attracting industry players from around the world to

launch or expand their business in Hong Kong. Hong

Kong, being a duty-free port with good air

connectivity and storage facilities, is regarded by

Asian investors as the most cost-effective and

convenient distribution hub to store their

investment-grade wines for delivery to their markets

on-demand.

Performance of Hong Kong's Wine Trade

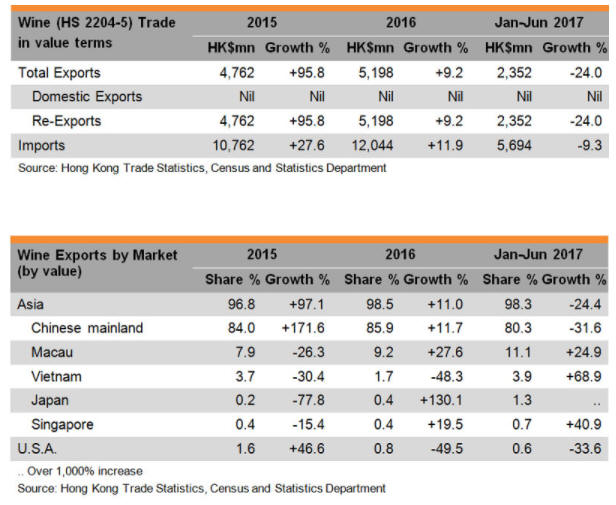

[1]

Since the weather in Hong Kong is not

suitable for growing grapes, there is only very

little wine production in Hong Kong, and therefore

insignificant domestic exports. Virtually all

exports are re-exports of imported wines with Asia

being the major market. Chinese mainland and Macau,

taking up more than 91% of the total in the first

half of 2017, are the major wine exporting

destinations of Hong Kong. In January-June 2017,

total exports of wine saw a sharp decline of 24%,

after a 9% growth last year.

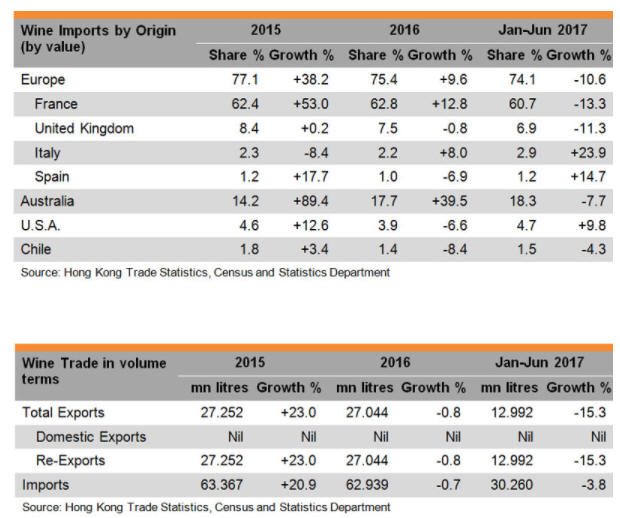

On the other hand, Hong Kong’s wine

imports have expanded fast since the elimination of

import duties in February 2008. In January-June

2017, imports of wine amounted to HK$5.7 billion,

more than three times of the value of HK$1.6 billion

in 2007. Most of the imported wines originated from

European countries such as France and the United

Kingdom, but there has also been a significant share

coming from Australia in recent years. In the first

half of 2017, the value of wine imports decreased by

9%, led by those originated from France (-13%) and

the United Kingdom (-11%).

In volume terms, Hong Kong imported

30.3 million litres of wine in the first half of

2017, with about 43% of these imported wines being

re-exported. The rest – about 57% – of wine imports

were brought away from Hong Kong by individuals or

retained in Hong Kong, for storage or immediate

consumption.

Sales Channels

To facilitate Hong Kong as a trading

and distribution hub for the region, the Hong Kong

government has signed co-operation agreements with

Australia, Chile, France (and its Bordeaux and

Burgundy regions), Germany, Hungary, Italy, New

Zealand, Portugal, Romania, Spain and the United

States (and its Oregon and Washington states) to

strengthen promotional activities in areas including

wine-related trade, investment and tourism. Various

wine promotional activities, including seminars,

wine tastings, receptions and food pairings, also

take place in Hong Kong. In particular, trade fairs

in Hong Kong provide good business matching

opportunities, support new wines and labels

launches, and facilitate market testing on Asian

Palette. Below is a list of selected trade fairs in

the industry.

High-value, investment grade wines

are usually sold through auctions organised by

global auction houses including Acker

Merrall & Condit, Sotheby’s, Christie's

and Zachys. Thanks to the surge in demand from

Asian investors, Hong Kong has maintained one of the

largest wine auction centres in the world since

2009, with auction sales amounting to US$92 million

in 2016, according to Wine

Spectator.

Domestically, wines are sold through

off-trade channels such as supermarkets, specialty

stores and convenience stores, and on-trade channels

such as bars, restaurants and club houses. According

to Euromonitor

International, wine sales in Hong Kong amounted

to US$1,543 million or 33.8 million liters in 2016,

up 6.5% and 3.1%, respectively, per annum in the

past five years. For 2016 to 2021, it is forecast to

grow 9.8% per annum in value terms and 5.4% per

annum in volume terms. Off-trade channels account

for approximately 24% of total wine sales in value

terms and 39% in volume terms in 2016.

Industry Trends

While wine consumption is flat or

sinking across much of Europe, the global attention

has shifted to Asia. Consumers in Asia are

increasingly wine savvy and their demand for wine

remains strong. According to Euromonitor

International, wine sales in Asia amounted to

US$93.3 billion or 6.1 billion litres in 2016, up

2.3% and 2.3%, respectively, per annum in the past

five years. For 2016 to 2021, it is forecast to grow

8.5% per annum in value terms and 3.9% per annum in

volume terms. Sales in China are more spectacular,

with an amount of US$66.5 billion or 4.6 billion

litres in 2016, up 4.7% and 3.5%, respectively, per

annum in the past five years. For 2016 to 2021, it

is forecast to grow 10.4% per annum in value terms

and 5.0% per annum in volume terms.

Due to the growing demand for wine in

Asia and the deregulation of wine imports, wine

business has boomed in Hong Kong. Besides new

entries, increasingly, international wine companies

and their specialists have moved to Hong Kong. For

example, Robert Sleigh, senior director and head of Sotheby's wine

department in Asia, has been relocated to Hong Kong

from New York since September 2010. Also, after six

years in Singapore, the Regional

Council of Burgundy has moved its only office

in Asia to Hong Kong. On the other hand, while Hong

Kong is well recognised as the culinary centre in

the region, wine matching with Asian cuisine becomes

a trend in the form of food and wine appreciation

sessions held by restaurants and hotels. There is

also a food matching competition adjudicated by

Asian experts in the HKTDC

Hong Kong International Wine and Spirits Fair.

Responding to rising demand and

driven by market forces, public as well as private

training institutions are enriching or expanding

their wine appreciation courses and developing

enhanced manpower training programmes. For instance,

the Vocational

Training Council (VTC) offers trainings to

personnel ranging from sommeliers to frontline

catering staff, and provide training on food and

wine pairing, wine appreciation and other

wine-related matters through the International

Culinary Institute, its member institute.

Meanwhile, the School

of Professional and Continuing Education of

the University

of Hong Kong has partnered with a French

institution to launch the first Master of Business

Administration’s programme in Hong Kong on wine.

To support on-demand delivery to

Asian market, storage facilities are necessary and

being built and converted in Hong Kong. With the

assistance of the government, the industry and the Hong

Kong Quality Assurance Agency launched the Wine

Storage Management Systems Certification Scheme, the

first of its kind in the world. The Scheme has been

enthusiastically supported by the industry, with a

total of 66 fine and commercial wine storage

facilities, wine storage facilities in wine

retailers and/or wine transportation service

providers accredited as of November 2016.

CEPA Provisions

Under the Mainland

and Hong Kong Closer Economic Partnership

Arrangement (CEPA), the mainland has given all

products of Hong Kong origin, including wine,

tariff-free treatment starting from 1 January 2006.

According to the stipulated procedures, products

which have no existing CEPA rules

of origin can enjoy tariff-free treatment upon

applications by local manufacturers and upon the CEPA rule

of origins being agreed and met. Non-Hong Kong made

wine is subject to tariff rates of up to 20% when

entering the mainland.

Generally speaking, for wine of fresh

grapes, fermentation and production, identified as

the principal process for the purpose of delineating

their origin, is required to be carried out in Hong

Kong. Detailed information is available here.

General Trade Measures Affecting Wine

Exports

The Chinese mainland is the biggest

export market for Hong Kong. It imposes the

following taxes on wine: import tariff (14% for

bottled wine and 20% of bulk wine), value added tax

(17%) and consumption tax (10%), which results in an

effective tax rate as high as about 48-56%. The two

most critical pieces of legislation concerning wine

imports are the wine standards and the wine

labelling law, both of which are administered by

the General

Administration of Quality Supervision, Inspection

and Quarantine (AQSIQ). Some standards that

apply to wine are “Standards for the Administration

of Wholesaling of Alcoholic Products”, “Standards

for Administration of Retailing of Alcoholic

Products”, “Measures for the Administration of Wine

Distribution” and “Hygiene Standards of Distilled

and Brewed Wine”. However, these standards do not

necessarily correspond with international standards.

Labelling verification must be sought

from AQSIQ,

a process which takes one to two weeks. All

information labelled in English must also be equally

given in Chinese and in the same size font. All

labels must be permanently attached to the bottles.

Separately, the port requires a 24-hour notice prior

to shipment arrival. According to customs inspection

regulations, samples will be selected randomly and

proportionately. Less than 1,500 ml will be sampled

if the bottles contain less than 500 ml. There is

currently no wine classification or grading system

in China.

To facilitate the movement of wine

imports into the Chinese mainland through Hong Kong,

the Customs

and Excise Department (C&ED) of Hong Kong and

the General

Administration of Customs of the Chinese

mainland signed on 9 February 2010 the "Co-operation

Arrangement on Customs Facilitation Measures for

Wine Entering the Mainland through Hong Kong". The

agreement applies to wine which is imported through

designated ports into the Chinese mainland, exported

by Hong Kong registered wine exporters and imported

by mainland registered wine importers. The measures

include pre-valuation of duty whilst the wines are

in Hong Kong and compression of clearance time at

mainland ports. The agreement now applies to all

ports in Beijing, Tianjin, Shanghai, Guangzhou and

Shenzhen. On 18 September 2014, the two Customs

administrations signed a supplement to the

Arrangement to enhance the facilitation measures.

The supplement waived the requirement that wine

consignments from Hong Kong have to be received by

the Mainland Registered Wine Importers, and mandated

the use of a newly developed web-based system for

declaration of wine consignment information to the

mainland customs.

C&ED has

stepped up efforts to tackle counterfeit wine, which

include establishing a dedicated investigation team;

forming an alliance with the industry to strengthen

co-operation in intelligence collection and enhance

their capacity in monitoring market activities;

setting up a specialist team under the alliance,

drawing in experts to assist in enforcement against

counterfeit wine; as well as establishing a liaison

network with overseas and Chinese mainland

enforcement agencies to enhance its capability in

intercepting suspected counterfeit wine and verify

wine authenticity.

Product Trends

More “laymen” labelling and bottle

closures

Wines were traditionally selected

from a wine menu or list without the customers ever

seeing the bottle. Amid the rise of off-trade

channels, wine packaging, in terms of label design

and bottle closure, becomes more important. Now,

wine labels show more information such as the

vintage, the variety and the country of origin.

Label designs are increasingly eye-catching and easy

to recognise as brands can play a big part in wine

selection. For example, Australia’s Yellow Tail

whose distinctive orange kangaroo logo has helped

the brand sell more than 25 million cases in five

years. To make it more user friendly, screw caps,

crown seals, synthetic corks are increasingly used

as alternatives to traditional corks as bottle

closures.

Targeting the entry-level tasters

According to Euromonitor

International, there are more products which

target entry-level tasters and people new to wine

consumption launched in recent years. Examples

include Ruffino

Lbaio Chardonnay by Ruffino

SRL, and Barefoot

White Zinfandel by Barefoot

Cellars. Another company, Te

Hana, also launched Te

Hana Rose Cuvee, a low-price Champagne

available in PARKnSHOP targeting

low- to middle-income consumers.

Wine packaged in smaller bottles

Some wine retailers packaged the same

wines in large and small bottles. The idea is to

allow consumers to replicate a winery tasting room

in the comfort of their own homes, trying a taste of

top-notch wines before committing to buying

full-sized 750 ml bottles.

Companies introduce wines to be

paired with certain foods

An increasing number of consumers

have started to develop a more sophisticated

palette, and are hence consuming more wine.

According to Euromonitor

International, regional companies have started

to launch their products in a bid to appeal to the

local palette.

Source: HK

Trade Development Council |